The National Bank for Agriculture and Rural Development (NABARD) has released the Potential Linked Credit Plan (PLP) for the financial year 2025-26 for the Mysuru district and the projection is pegged at ₹22,816.18 crore.

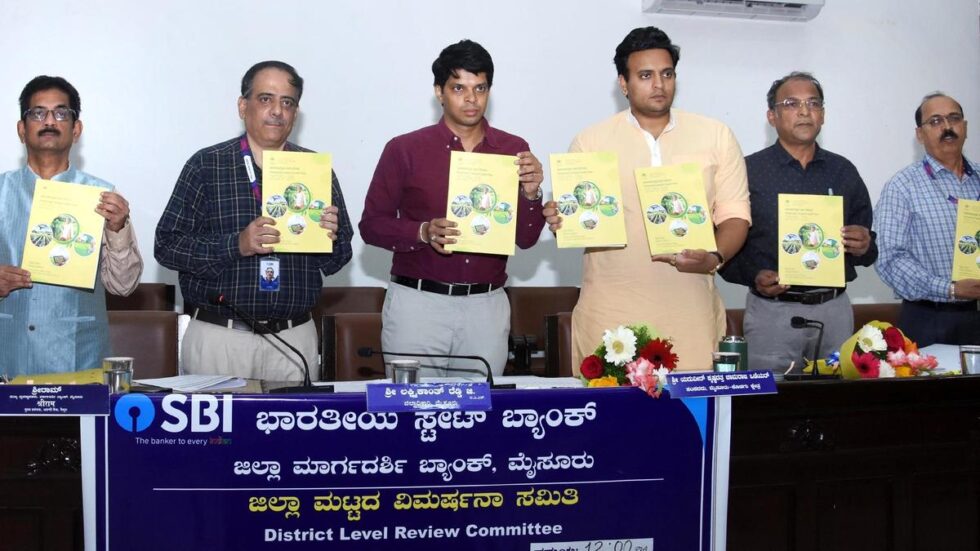

The PLP was released by MP for Mysuru Yaduveer Krishnadatta Chamaraja Wadiyar, Deputy Commissioner G. Lakshmikanth Reddy, and representatives from Reserve Bank of India, NABARD, Lead Bank, and others, during the District Consultative Committee (DCC) meeting here on Friday.

Agriculture continues to be accorded top priority, with credit projections for the sector pegged at ₹12,105.28 crore. Of this amount, ₹6,692.43 crore is designated for crop loan. The projections for the term loan are estimated at ₹1,655.63 crore. For agriculture infrastructure, the potential is ₹387.77 crore. The amount projected for ancillary sectors under agriculture is ₹3,369.45 crore, as per the PLP.

The projection for MSME is assessed at ₹8,244.79 crore. The projection for export is ₹547.20 crore, housing ₹503.55 crore, education ₹268.56 crore, social infrastructure ₹39.96 crore, renewable energy ₹15.12 crore, and ₹1,111.72 crore is assessed for ‘other priority sector’’.

Taking a broader look at the thrust areas driving the economy of the district, NABARD CLP has indicated that agriculture and MSMEs accounted for 93% of the ground-level credit flow during 2023-24, and the same pattern is expected to be witnessed in the coming financial year as well.

It has also taken note of the government’s Beyond Bengaluru Mission under Karnataka Digital Economy Mission (KDEM) to point out that 5000 IT startup companies are expected to be hosted in the industrial clusters of Mysuru, Mangaluru, and Hubbali by the end of 2026, which will result in job generation for over 10 lakh people.

The NABARD’s PLP, which provides a detailed assessment of credit potential for various sectors in the district, also highlights sector-specific infrastructure gaps and critical interventions that need to be made to realise the full potential. It has identified a few major constraints concerning infrastructure in industrial areas and said there was scope for improvement.

These interventions relate to improvement in road connectivity, drainage, etc. in industrial areas and they can have a significant impact in terms of investments and employment generation in the district given the Beyond Bengaluru initiative of KDEM.

It has also flagged the concentration of all industries in the Mysuru and Nanjangud blocks and called for the focus to establish industrial areas in Hunsur and Periyapatana as they are on the Mysuru-Kodagu stretch.

There was also a discussion and review of the performance of banks in implementing various government schemes and the MP and the Deputy Commissioner red-flagged the number of applications rejected or pending under the PM Vishwakarma scheme, Prime Minister Employment Generation Scheme, etc.

Mr. Yaduveer called for additional statistics to reflect the larger picture and said that it was imperative to assess why some potential beneficiaries are unable to access financial assistance under different schemes.